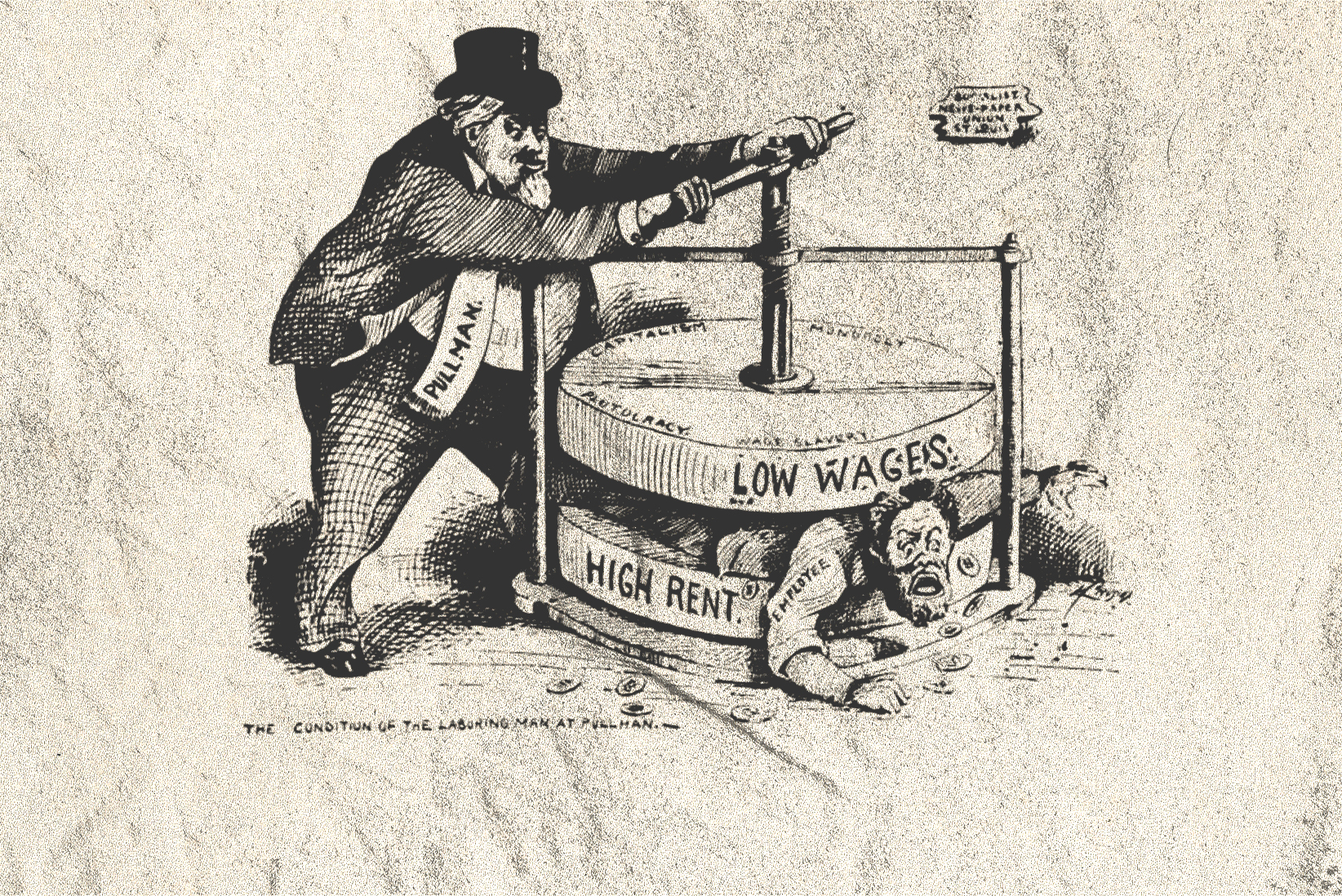

Tiff Macklem, the governor of the Bank of Canada, recently told businesses that it was their duty to attack the living standards of workers for the sake of inflation. Despite the fact the corporations are making record profits, and there is absolutely zero evidence linking wages to inflation, Canada’s top banker insisted that workers must be forced to suffer. There can be no better evidence that capitalism is an anti-worker system and that workers must fight for its overthrow.

Speaking to the Canadian Federation of Independent Business (CFIB), a right-wing corporate lobbying outfit that typically opposes workers’ rights, Governor Macklem discussed the issue of inflation. Inflation has reached a 39-year high at 8.1 per cent. Wages, by comparison, have increased at less than half this amount, rising at a rate of 3.1 per cent. In real terms this means that workers have suffered a five per cent erosion in living standards over the last year, with more bad news to come.

However, the reality that wages are not causing inflation did not hinder the governor from saying that the poor must be forced further into poverty. Macklem said to his fellow capitalists, “So as a business, don’t plan on the current rate of inflation staying. Don’t build that into longer-term contracts. Don’t build that into wage contracts. It is going to take some time, but you can be confident that inflation will come down.” This is very rich, coming from a man whose take-home pay exceeds $400,000. He appeals to the bosses to continue profiteering off the back of low wages while he admits “it is going to take some time”!

Inflation is not in any way due to wages. Instead it is due to a mix of corporate profiteering with the reduced value of money as a result of quantitative easing, low interest rates, and government handouts to corporations. These money-printing exercises and corporate welfare did nothing but benefit the speculators and stock brokers, but now they are forcing workers to pay for it. It is basic math that if the amount of goods and services in an economy remains the same, but the supply of paper money increases, prices will increase by a proportionate amount.

‘Wage-price spiral’ nonsense

Macklem cited the “wage-price spiral” as justification for attacking workers. This right-wing theory is a very convenient excuse to blame everything on workers, no matter how much it is contradicted by real-world analysis. Again, we need to remember that wages have been flat while prices are going up, so wages cannot be the cause of inflation. In the 1970s Trudeau Sr. used this idea to attack the working class and transfer wealth from the poor to the rich. Now this corporate “theory” has been dragged out of the dustbin of history by today’s governor of the Bank of Canada.

Basically, the wage-price spiral is the idea that if prices go up workers will demand higher wages to maintain their standard of living. But if workers demand higher wages, then capitalists will raise prices to compensate. And then workers demand more, and bosses put prices up more, in a never-ending spiral until a loaf of bread costs $1 million. The problem with this “theory” is that it assumes that prices can be set at a whim and that profits are merely an arbitrary percentage added onto costs. Also, when Tiff Macklem and co. explain this idea they conveniently leave out the words “capitalists” and “profits”. They present it as though prices magically go up by themselves without the conscious intervention of a corporate freeloader pocketing more and more in profits. This has the result of putting all the blame on workers for asking not to be poorer, rather than bosses for raising prices and profiteering. By a linguistic trick the capitalist has disappeared and the only person with agency and responsibility is the worker.

Prices only go up when wages go up if profits also go up. Why is the banker who sucks up $400,000 per year so concerned about wages but totally fine about the role corporate profits play in setting prices? This rhetorical question answers itself. If the wage-price spiral is real (which it isn’t), it could just as easily be ended by corporations lowering their rate of profit rather than lowering wages.

Corporate profiteering

In fact, profits have not gone down in the recent period; they have shot through the roof. Corporate profits in Canada are currently $402 billion per year, up from $344 billion in 2021 and $192 billion in 2020. This is a 109 per cent increase in two years! Other studies show that corporate profits have swelled from 12.4 per cent of GDP in 2019 to 15.2 per cent in 2022. Meanwhile wages have shrunk by one per cent of GDP. During the 1960s, ’70s, and ’80s profits averaged at around nine per cent of GDP, showing how there has been a massive increase in profiteering in recent decades. Profit margins have also gone up. Profit margin is the amount that revenue from sales exceeds costs. Margins averaged nine per cent from 2002-2019, but almost doubled to 16 per cent in 2021. In some sectors such as food the situation is even worse. Grocery inflation stands at 9.9 per cent, approximately two per cent above core inflation. At the same time grocery giants like Loblaws have increased their profit margins to 30.9 per cent, while their earnings have more than doubled!

Tiff doesn’t seem to care about the effect of profiteering on prices, but perhaps he will appeal to his buddies in the boardroom to limit their pay for the good of the people? Surely if workers’ wages lead to inflation so should CEO wages. Unsurprisingly the Bank of Canada has nothing to say about the fact that total CEO pay of the top 100 Canadian corporations shot up 32 per cent in 2021. These 100 plutocrats brought home a combined $1.16 billion while workers are being asked to take cuts.

The fact that the wage-price spiral is bunk was explained by Marx over a century and a half ago. Prices are not arbitrary. They are not just a fixed (or increasing) percentage above costs, and they cannot just be set at a whim by any capitalist. Prices fluctuate around the socially necessary labour time it takes to produce a commodity. If a commodity takes the same time to produce, and the value of money stays constant, then on average the price will not change.

A worker is not paid for the labour they do, but for their ability to work—the value of which typically encompasses fewer hours than contained in the working day. The difference between the pay of the worker and the length of the working day is known as surplus value. If a commodity takes 10 hours to produce, and a worker is paid five hours’ worth to produce it, that leaves five hours of surplus value as profit for the capitalist. But if workers’ wages increase to the equivalent of six hours, the commodity they are producing still only takes 10 hours to produce. The value of the commodity is the same and if the value of money remains the same then the price would remain the same.

Increasing wages does not change the value of a commodity, it just decreases profits. Similarly, decreasing wages does not change the value of the commodity, it just increases profits. This explains why bankers like Tiff Macklem are working so hard to decrease real wages—they want to increase profits for the capitalists! When was the last time anybody saw a reduction of prices with decreased wages? Wages are pushed down all the time, and yet prices still go up. The boss just expropriates the surplus profit.

How to end inflation

There are many factors that lead to inflation, even if the data and theory show that wages are not one of them. There are temporary factors such as supply chain disruptions in the aftermath of the pandemic. There is also corporate profiteering which plays a role. One study estimated profiteering to encompass 60 per cent of inflation in the U.S.A. Some have questioned this figure, but regardless, profiteering clearly is a factor. However, while 60 per cent is big, it is not 100 per cent. Corporate bailouts funded by quantitative easing (aka money printing) and low interest rates have also reduced the value of money. When there are more pieces of paper to represent the same hours of value in an economy, then the value of the pieces of paper goes down. Some on the left think that you can just print money with no consequences. They are wrong, and are unwittingly justifying the massive corporate welfare seen in 2020 and 2021.

The first task in ending inflation is for workers to refuse to take below-inflation wage increases. We must fight for cost-of-living adjustments (COLA) and catch-up pay for all the past erosion in real wages.

Secondly, we must stop capitalist profiteering. All of these corporations must be forced to open the books so the entire working class can see exactly what goes to wages, to profits, to prices, and to CEO pay.

However, we must recognize that while these corporations remain in private hands there is nothing we can do to stop them raising prices. You cannot control what you do not own. Armed with all the information, the workers must take over running these companies from the parasitic CEOs who have extorted their 32 per cent pay increase off the backs of workers and consumers. Workers will be able to democratically determine a true and a fair price for all commodities, without profiteering.

Finally, we need to nationalize the banks and kick out right-wing parasites espousing the unscientific wage-price theory, like Tiff Macklem. This will give us the tools to rationally allocate resources without money printing for wasteful corporate bailouts and stock market speculation. In addition, the expropriated companies under workers’ control can then be integrated into a democratic socialist plan of production. The conscious intervention of the working class will allow us to end chaotic supply disruptions suffered by capitalism. Capitalist production for profit leads to disorganization and a lower standard of living for the working class. If you don’t believe us that capitalism leads the workers to be poorer, then just listen to the governor of the Bank of Canada who is espousing that as official policy! Instead we need democratic production for human need. We need socialism to end inflation and the high cost of living.