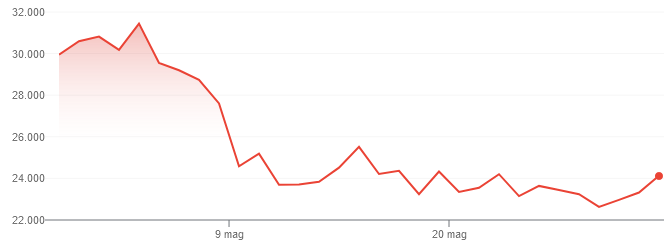

This May, a collapse on the scale of the largest crashes in recent history rocked markets. The Nasdaq stock exchange fell by almost 30% in one week, and the market capitalisation of cryptocurrencies simultaneously fell by 50%. Hundreds of billions of dollars were wiped out in just seven days. Since then, there has been no recovery.

The crash centred on speculative tech stocks and cryptocurrencies, which tumbled in price, having already begun to slide downwards earlier in 2022. Frenzied speculators have been throwing money at dubious tech start-ups and made-up currencies for years, but after the party, the hangover is starting to hit.

This hasn’t just affected ‘tech bros’ and rich investors. Many workers have invested in the stock market or cryptocurrencies in recent years, lured by the promise of making easy money. In 2020 and 2021, 15 million Americans downloaded trading apps and 16% of Americans claimed to have bought cryptocurrencies.

The crash caused a lot of ordinary workers to lose huge sums of money, in some cases their life savings.

On Reddit, small investors were expressing their dismay. “I’m going through some of the darkest, most severe mental pain of my life. It still doesn’t seem real,” wrote one user. Another lost $450,000 and is now unable to pay back a loan to the bank. Others are on the verge of losing their homes. Several are contemplating suicide.

And the worst could still be yet to come. One week after the crash, tech stocks and cryptocurrencies seem to have stabilised. But the conditions which created the crash have not gone away. The Crypto Fear & Greed Index is showing that people who invest in cryptocurrencies are approaching the market with “Extreme Fear” about the future.

Coinbase, the largest hub for exchanging cryptocurrencies, reported that its trading fell by 40% in the first quarter of 2022, creating losses of $430 million. This stunned analysts, who expected losses of $47 million. This crisis runs far deeper than even the ‘experts’ realise.

Coinbase has warned its customers could lose all of the $256 billion deposited with it if the company goes bankrupt.

Contagion

The impact of this crash, and likely future ones, will not be limited to direct investors. So much money is tied up in speculative assets that a crisis can spill over into other sectors.

During the recent crash a cryptocurrency called Terra collapsed. This caused a rush to convert other cryptocurrencies into dollars.

Investors in a cryptocurrency called Tether withdrew $7.6 billion from the digital currency into dollars in one week. That figure has now reached $10 billion. The problem is that the people who run Tether don’t have $10 billion in cash to give back to their investors. They have about half that, the rest being tied up in undisclosed assets such as US government bonds.

To meet the demand for withdrawals, the owners of Tether will be forced to rapidly sell off some of these assets. A rapid sell off of US government bonds will push the price of those bonds down. That, in turn, will devalue the investments of every bank and investor who holds those bonds, causing a crisis throughout the economy.

With a huge amount of money deposited in cryptocurrencies, entities like Tether are effectively huge shadow banks, investing billions of dollars in the real economy. They do so in secret and with little-to-no regulation.The rapid withdrawal rate from Tether is effectively a run on this bank which will have big ramifications.

This wild-west casino capitalism is a huge risk to the wider economy. This is why the Financial Times has issued a demand for tighter regulation of cryptocurrencies. It’s also why China effectively banned cryptocurrencies last year, and why the European Central Bank warned last week that “cryptoassets represent a risk to financial stability”.

The founder of Dogecoin, a cryptocurrency based on internet memes, commented that “crypto is 95% scams and garbage”. The global cryptocurrency market currently has $1.4 trillion circulating around it. This means just over 1.5% of the world’s GDP (equivalent to the entire economy of Spain) is tied up in ‘scams and garbage’.

That is a titanic economic loose cannon to have crashing around the world economy as it heads for very choppy waters.

How have we got here?

This crash has been a long time coming. Ever since 2008, quantitative easing (QE) has been carried out by central banks around the world. This means money has been created out of nowhere and fed into the economy to prevent economic collapse.

The idea was that by pumping money into the system, interest rates could remain low. That would encourage borrowing and investment, which would stimulate consumption, create jobs, and get the economy back on track.

According to the Atlantic Council’s global QE tracker, the four main central banks – in the USA, the Eurozone, the UK, and Japan – have injected $26.7 trillion into the global economy in this way, which is almost one third of world GDP.

This decade-old policy was turbo-charged in 2020 to tackle the pandemic. An additional $10 trillion surged into the global economy to cover furlough for workers, loans for businesses, and other pandemic-related expenses.

Those policies were not a mistake or a swindle. They were necessary for the capitalists to preserve their system from collapse in 2008 and 2020. But they didn’t solve the underlying problems. They just kicked the can down the road to avoid economic catastrophe in the short term. In doing so they made the problems bigger and hoped to deal with them at a later date.

Thanks to inflation, war, and protectionism, that later date is arriving. The recent crash in tech stocks and cryptocurrencies is an early tremor of the impending earthquake.

Speculative tech and crypto

The problem for the strategists of capital is that not much of these tens of trillions of dollars pumped into the economy has been invested in real world production over the last ten years. That’s because there isn’t much scope for making a profit in a world economy riddled with capitalist overproduction.

Instead, all of this cheap, easy money has been poured into speculation in the stock market and other assets. The capitalists have been making money out of money by betting on share prices.

The likes of Uber are an example of a speculative tech company that has ridden the wave of cheap money over the last ten years.

Uber began in 2009, and by July 2015 was the most valuable start-up in the world, having raised $51 billion from investors despite never having made a profit.

Money has been so cheap, and profitable investments so scarce, that investors have been happy to accept losses speculating on a tech company which they think might make a profit at some point in the future.

Uber is now a publicly traded company with over $81 billion invested in it as of 2021, despite never having made a profit in twelve years.

Speculative tech companies like Uber, Netflix, Meta, and Spotify have based themselves on trillions of dollars of easy money sloshing around the global financial system for the last ten years.

Parallel to this, we’ve seen the phenomenon of cryptocurrencies and other so-called ‘digital assets’ such as NFTs. A torrent of QE, low interest cash has washed into these inherently worthless, speculative assets in the last few years.

Between 2013 and 2020, the global cryptocurrency market went from investment of $1.5 billion to $350 billion.

That increase is nothing compared to what happened in 2021. From $350 billion the money invested in cryptocurrencies reached $2.9 trillion within 12 months.

Digital assets such as NFTs are part of the same process. Between 2018 and 2020, the money invested in NFTs went from $41 million to $372 million. 2021 saw a colossal increase to almost $17 billion.

We can see why one investment manager told the Financial Times that “2021 has earned its place in the books as the wildest and most speculative year in US stock market history, eclipsing even 1929 and 1999”.

What does the future hold?

Now things are changing. The sun is setting on the era of cheap, easy money. Interest rates are rising and QE is being wound down, so there’s less incentive to invest in risky assets, and fewer cheap loans available to speculate with.

Supply chain problems, protectionism, and war are bringing crises to every country’s economy. Instability and uncertainty tends to result in capitalists keeping their money away from volatile, risky assets such as speculative tech and cryptocurrency.

The combination of these factors led to the recent crash.

Uber, which was worth $81 billion at the end of 2021, is now worth just $47 billion. Netflix was worth over $300 billion in November 2021, but is now worth $84 billion. The total money invested in cryptocurrencies is down from almost $3 trillion in late 2021 to $1.4 trillion today.

The crisis facing the real economy means the capitalists are less willing and able to speculate on unprofitable companies or worthless digital assets.

Crypto-lunacy

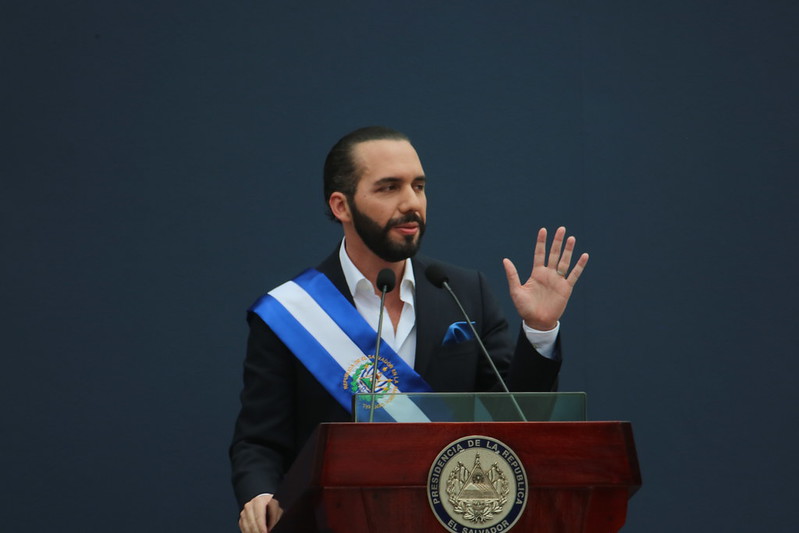

Others among the capitalist class are refusing to look reality in the face. The president of El Salvador is one example. He made Bitcoin legal tender in the country last year, despite the IMF pleading with him not to do so. Since then the cryptocurrency has lost almost half its value, costing the country $40 million.

“It’s an investment that is totally at the discretion of the president,” said former El Salvador Central Bank Chief Carlos Acevedo recently. “He buys it on his phone when he wants to take advantage of the dip, but he doesn’t do it right because when he buys there’s always a bigger dip.”

The country now has an 87% chance of defaulting on its debt in the next five years.

Meanwhile, in the same week as the crash, and completely disconnected from reality, a huge cryptocurrency conference was getting underway in the Bahamas. It was a scene reminiscent of Nero fiddling while Rome burned.

Cryptocurrency kingpins were enjoying a candlelit dinner with celebrities like Katy Perry and Orlando Bloom, while billions were being lost and people’s life savings were going up in smoke. Cryptocurrency, these decadents insisted, is still very much the future.

One conference session titled ‘Elevating Crypto Consciousness’ was a discussion about how people could use hallucinogens to stop worrying and love crypto, according to the Financial Times. Tony Blair and Bill Clinton even put in an appearance at the event, which fittingly was held in a casino in the Bahamian capital.

No solutions under capitalism

Others from among the capitalist class are proposing to fix the problem by making it much worse. The owners of Coinbase are planning to cover their recent losses by investing in ‘crypto derivatives’. This is like trying to cover your gambling losses by betting even bigger, at an even dodgier casino.

The more sober elements of the capitalist class have called for regulation of cryptocurrencies and realistic business models for speculative tech companies, involving them actually making a profit.

But these calls are like demanding sobriety from a drunk. There is nothing realistic about them. Capitalism is in a deep crisis and is wracked by chaos. It has gone far beyond its limits. Uncertain of the future, the capitalists are unwilling to make serious investments in the real economy. Instead of taking society forward, they attempt to get rich quick through wild speculation.

After 2008 the big banks were more tightly regulated, but that hasn’t stopped an unprecedented orgy of speculative investment since then. The recent crash has proved what a joke that so-called ‘regulation’ really was. The capitalists simply found a new way to make money: by trading trillions of dollars in made-up currencies and low-quality digital images.

The crisis facing the real economy may cool the orgy of speculation somewhat in the coming period, but the underlying contradictions of the capitalist system mean that one way or another the global economy will suffer growing instability.

The recent crash is a reminder of the urgent necessity of ridding ourselves of these gambling capitalist parasites. Then we can take control of the economy for ourselves, and invest these trillions of dollars in socially useful goods and services which will improve everyone’s standard of living.